Welcome to Medytox website.

Dividends

Dividend Policy

Our basic shareholder return policy aims to increase corporate value based on continuous growth along with

stable dividends based on the company's performance and to enhance shareholder return in the long term.

Our shareholder return is decided by comprehensively considering business performance, investment plan, financial status, and economic outlook.

The Company plans to strategically determine its dividend targets within the scope of distributable profits by thoroughly reviewing various factors affecting shareholder returns and maintaining a balanced approach between investments and shareholder value. The Company aims for a sustainable and gradual increase in dividends, targeting an annual par value dividend ratio of approximately 200% through quarterly cash dividends at the end of September each year.

Additionally, to mitigate sharp stock price fluctuations and enhance shareholder value, the Company is implementing share repurchases. However, the timing of specific decisions regarding dividend policies and share repurchases remains flexible, depending on the Company's circumstances and the overall economic environment.

Our shareholder return is decided by comprehensively considering business performance, investment plan, financial status, and economic outlook.

The Company plans to strategically determine its dividend targets within the scope of distributable profits by thoroughly reviewing various factors affecting shareholder returns and maintaining a balanced approach between investments and shareholder value. The Company aims for a sustainable and gradual increase in dividends, targeting an annual par value dividend ratio of approximately 200% through quarterly cash dividends at the end of September each year.

Additionally, to mitigate sharp stock price fluctuations and enhance shareholder value, the Company is implementing share repurchases. However, the timing of specific decisions regarding dividend policies and share repurchases remains flexible, depending on the Company's circumstances and the overall economic environment.

Dividends

Details

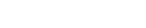

| Classification | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|

| Par Value Per Share (Won) | 500 | 500 | 500 | 500 | 500 | |

| (Consolidated) Net Income (Mil. Won) | 94,154 | 37,001 | 9,755 | 16,955 | - | |

| (Separate) Net Income (Won) | 107,460 | 36,842 | 18,567 | 21,908 | - | |

| (Consolidated) Earnings Per Share (Mil. Won) | 16,083 | 5,766 | 1,311 | 2,377 | - | |

| Total Cash Dividend (Mil. Won) | 0 | 8,041 | 8,422 | 8,424 | 8,919 | |

| Total Stock Dividend (Mil. Won) | 158 | 163 | - | - | - | |

| (Consolidated) Cash Dividend Rate (%) | - | 21.73 | 86.34 | 49.69 | - | |

| Cash Dividend Rate (%) | Common Stock | - | 0.88 | 0.42 | 0.57 | 0.96 |

| Preferred Stock | - | - | - | - | - | |

| Stock Dividend Rate (%) | Common Stock | 1.52 | 4.18 | - | - | - |

| Preferred Stock | - | - | - | - | - | |

| Cash Dividend Per Share (Won) | Common Stock | 0 | 1,000 | 1,100 | 1,100 | 1,200 |

| Preferred Stock | 0 | 1,483 | 2,315 | 2,315 | 2,324 | |

| Stock Dividend Per Share | Common Stock | 0.05 | 0.05 | - | - | - |

| Preferred Stock | 0.05 | 0.05 | - | - | - | |

1) (Consolidated) Net Income, was written based on the ownership stake of the parent company

2) Total Stock Dividend, were calculated by multiplying the number of shares paid as stock dividends (common shares + preferred shares) by the par value per share.

2) Total Stock Dividend, were calculated by multiplying the number of shares paid as stock dividends (common shares + preferred shares) by the par value per share.